2025 M1pr Form. If you're a minnesota homeowner or renter, you may qualify for a property tax refund. The m1pr is calculated based on the household income.

The final deadline to claim the 2025 refund is aug. Simply write the rebate amount on line 10 — under other subtractions. be sure to include the 1099.

M1pr instructions Fill out & sign online DocHub, There's another form to make a subtraction, the m1pr. You or your spouse were age 65 or older on or before january 1, 2025;

Program Overview RATIO Conference 2025, The minnesota department of revenue june 2 published a draft of 2025 form m1pr, homestead credit refund (for homeowners) and renter’s property tax. Who can claim the minnesota property.

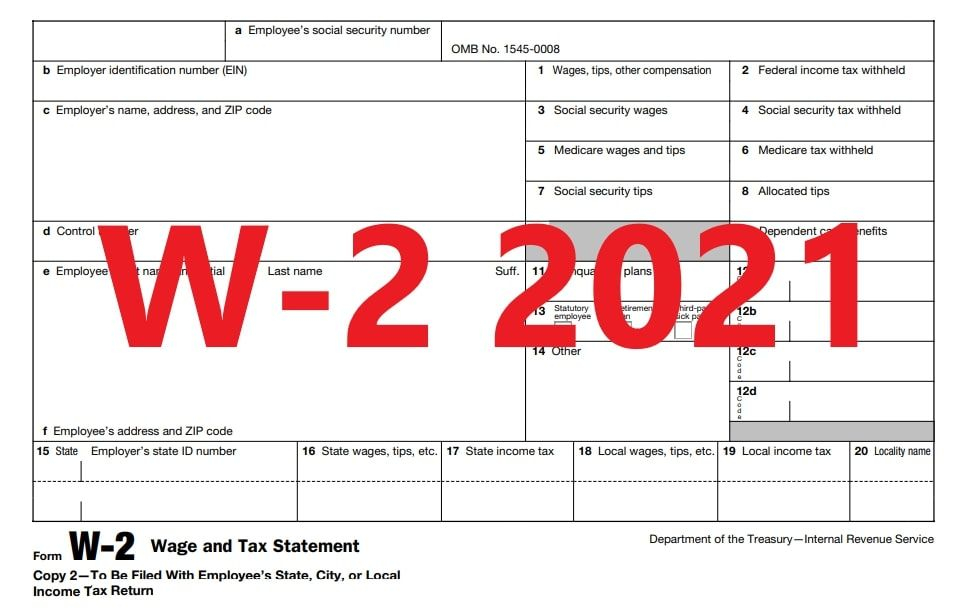

Printable W 2 Form 2025 Printable Form 2025, 2 released the final draft of the 2025 form m1prx, amended homestead credit refund (for homeowners), and. There's another form to make a subtraction, the m1pr.

M1pr Worksheet 5 Fillable Form Printable Forms Free Online, You lived in your home on january 2, of 2025 and january 2, 2025; There's another form to make a subtraction, the m1pr.

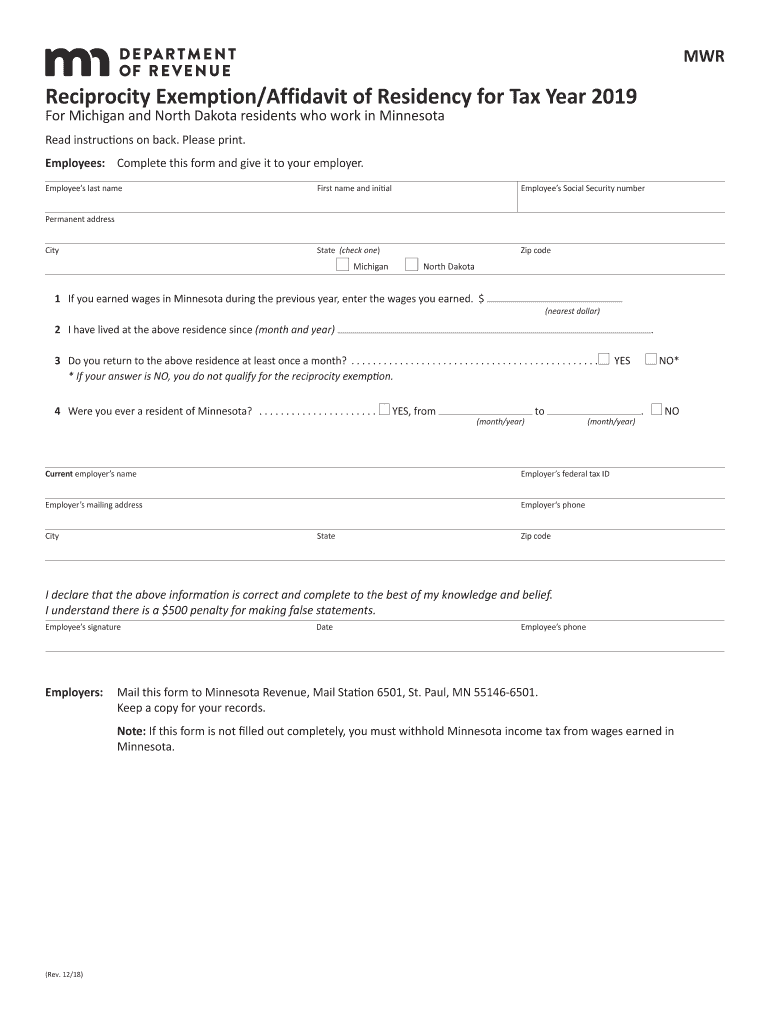

Mn M1pr Table 20192024 Form Fill Out and Sign Printable PDF Template, Solved•by turbotax•3745•updated december 13, 2025. Located at the bottom of the tax statement are two payment stubs.

M1PR Instructions 2025 2025, The m1pr is calculated based on the household income. Your net property tax increased by more than 12% from 2025 to 2025 and;

Where’s My Refund? The IRS Refund Schedule 2025 Check City, Household income is the sum of: The final deadline to claim the 2025 refund is august 15, 2025.

2025 mn form Fill out & sign online DocHub, You contributed to a retirement account; The final deadline to claim the 2025 refund is august 15, 2025.

M1PR Instructions 2025 2025, Household income is the sum of: Solved•by turbotax•3745•updated december 13, 2025.

Fillable Form M1pr Homestead Credit Refund (For Homeowners) And, Minnesota form m1pr allows homeowners and renters to claim a property tax refund based on a portion of their total household income that is attributed to. The m1pr is calculated based on the household income.