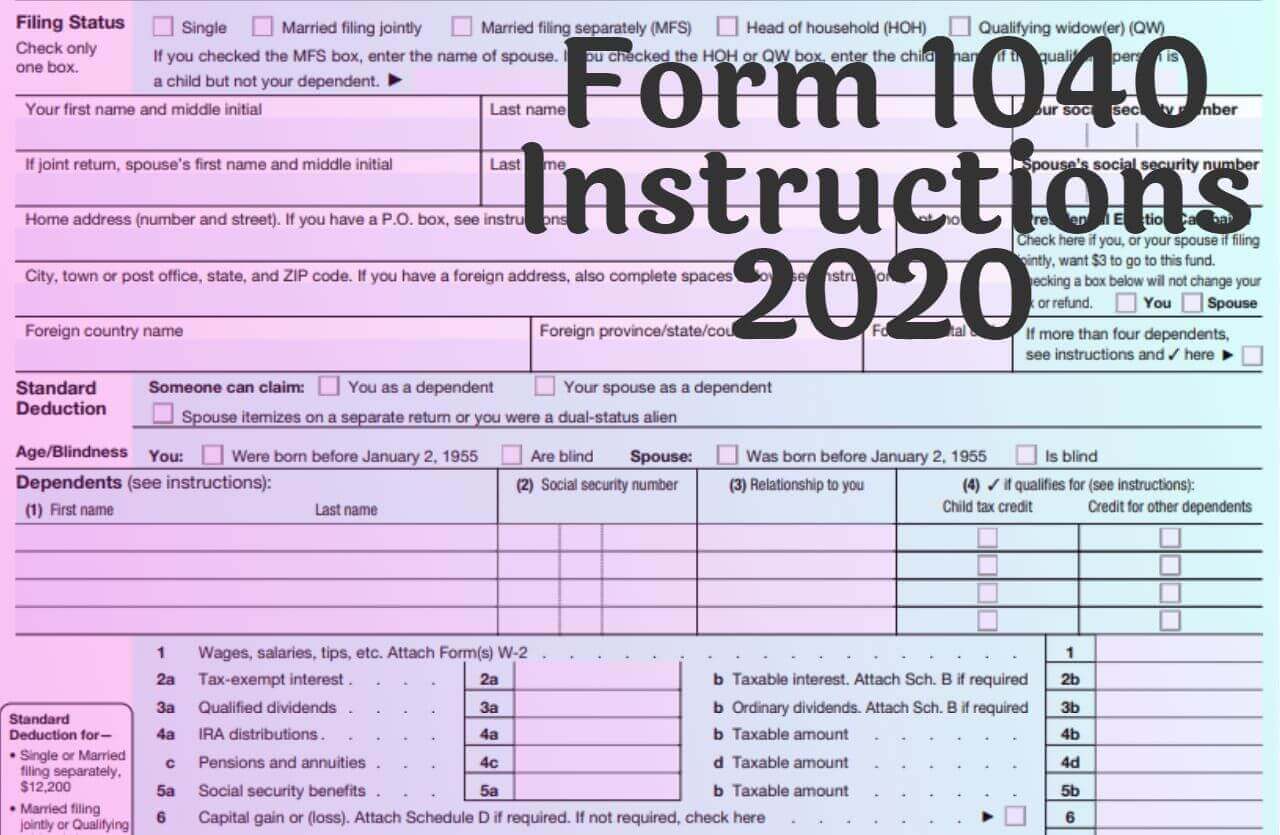

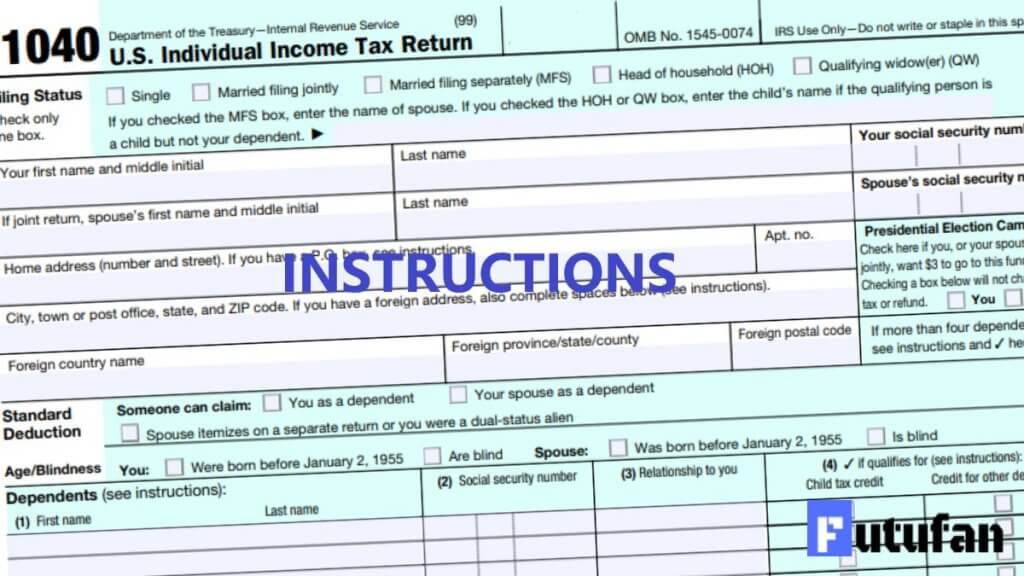

## 2025 IRS 1040 Schedule A

**Introduction Paragraph 1**

The IRS Schedule A is a form that allows taxpayers to itemize deductions on their federal income tax returns. Itemizing deductions can reduce your taxable income and result in a lower tax bill.

**Introduction Paragraph 2**

For the 2025 tax year, the IRS has updated the Schedule A form. The new form includes several changes, including the elimination of the deduction for unreimbursed employee expenses and the creation of a new deduction for qualified disaster losses.

**Transition paragraph from opening section to main content section**

In this article, we will discuss the changes to the 2025 IRS Schedule A form and provide guidance on how to complete the form.

The IRS Schedule A is a form that allows taxpayers to itemize deductions on their federal income tax returns. Itemizing deductions can reduce your taxable income and result in a lower tax bill.

These are just a few of the important changes to the 2025 IRS Schedule A form. Taxpayers should carefully review the form and consult with a tax professional if they have any questions.

For many years, taxpayers were able to deduct unreimbursed employee expenses on their federal income tax returns. These expenses included things like unreimbursed travel, meals, and entertainment expenses. However, the Tax Cuts & Jobs Act of 2017 eliminated the deduction for unreimbursed employee expenses for tax years 2018 through 2025.

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)

This means that taxpayers can no longer deduct these expenses on their 2025 tax returns. The elimination of this deduction is expected to raise $11.1 billion in revenue over the next 10 years.

There are a few exceptions to the elimination of the deduction for unreimbursed employee expenses. For example, taxpayers can still deduct unreimbursed employee expenses if they are self-employed or if they are performing services for a fee.

The elimination of the deduction for unreimbursed employee expenses is a significant change to the tax code. Taxpayers should be aware of this change and make sure that they are not claiming this deduction on their 2025 tax returns.

If you have any questions about the elimination of the deduction for unreimbursed employee expenses, please consult with a tax professional.

The Tax Cuts & Jobs Act of 2017 created a new deduction for qualified disaster losses. This deduction is available to taxpayers who have suffered a qualified disaster loss in a federally declared disaster area.

A qualified disaster loss is a loss that is sustained as a result of a federally declared disaster. The disaster must have occurred after August 23, 2017.

The deduction is available to individuals and businesses that have suffered a qualified disaster loss. The taxpayer must have owned the property that was damaged or destroyed in the disaster.

The deduction is equal to the amount of the loss that is not covered by insurance or other reimbursements. The deduction is limited to $500,000 for single taxpayers and $1,000,000 for married taxpayers filing jointly.

The deduction is claimed on the taxpayer’s federal income tax return. The taxpayer must complete Form 4684, Casualties and Thefts. The form must be filed with the taxpayer’s tax return for the year in which the disaster occurred.

The new deduction for qualified disaster losses is a valuable tax break for taxpayers who have suffered a disaster loss. Taxpayers should be aware of this deduction and make sure that they are claiming it on their tax returns.

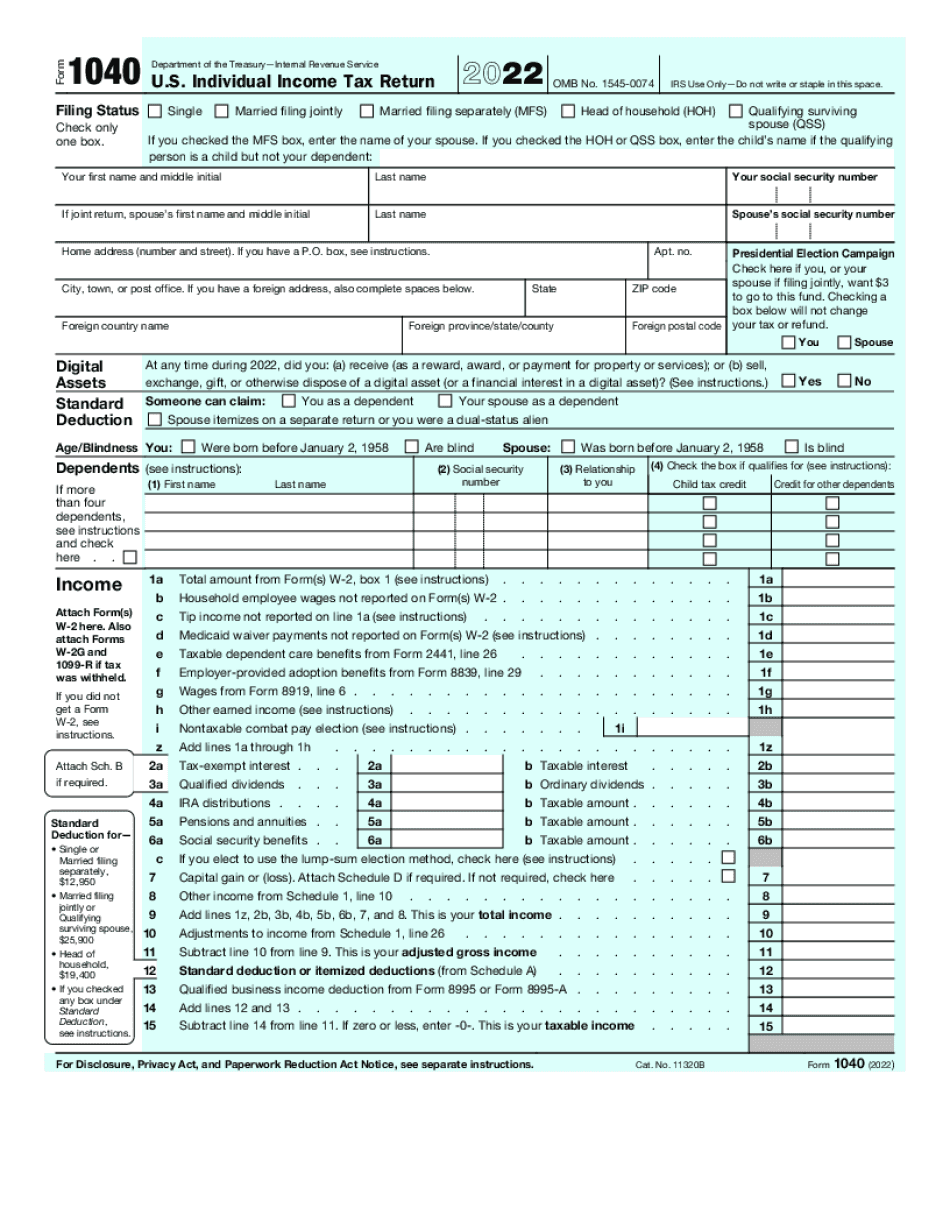

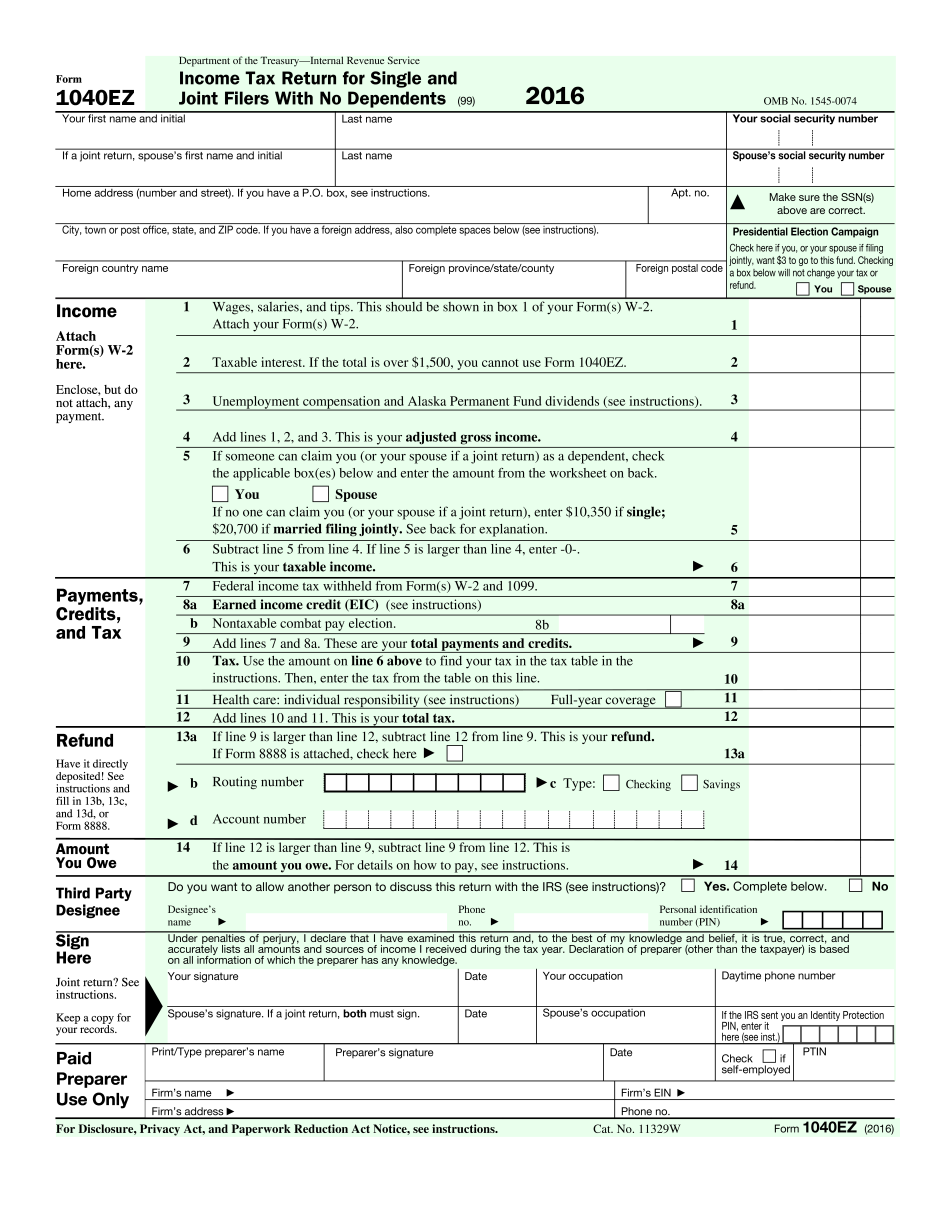

The standard deduction is a specific amount of income that you can deduct from your taxable income before you calculate your taxes. The standard deduction is a dollar-for-dollar reduction, which means that it reduces your taxable income by the full amount of the deduction.

The standard deduction for 2025 has been increased to $13,850 for single filers and $27,700 for married couples filing jointly.

Most taxpayers can claim the standard deduction. However, there are some exceptions. For example, taxpayers who itemize their deductions cannot claim the standard deduction.

You can claim the standard deduction by checking the box on your tax return that says “Standard Deduction.” You do not need to itemize your deductions if you claim the standard deduction.

Claiming the standard deduction is simple and easy. It can also save you time and money. If you do not have a lot of itemized deductions, claiming the standard deduction may be the best option for you.

The increased standard deduction for 2025 is a tax break for most taxpayers. Taxpayers should be aware of this increase and make sure that they are claiming the correct standard deduction on their tax returns.

For many years, the threshold for itemized deductions was 2% of the taxpayer’s adjusted gross income (AGI). However, the Tax Cuts & Jobs Act of 2017 increased the threshold to 10% of AGI for high-income taxpayers.

The increased threshold only affects high-income taxpayers. For 2025, the threshold is applied to taxpayers with AGI above $200,000 for single filers and $400,000 for married couples filing jointly.

The increased threshold means that high-income taxpayers will have to have more itemized deductions in order to itemize on their tax returns. This could make it more difficult for high-income taxpayers to reduce their taxable income and save money on their taxes.

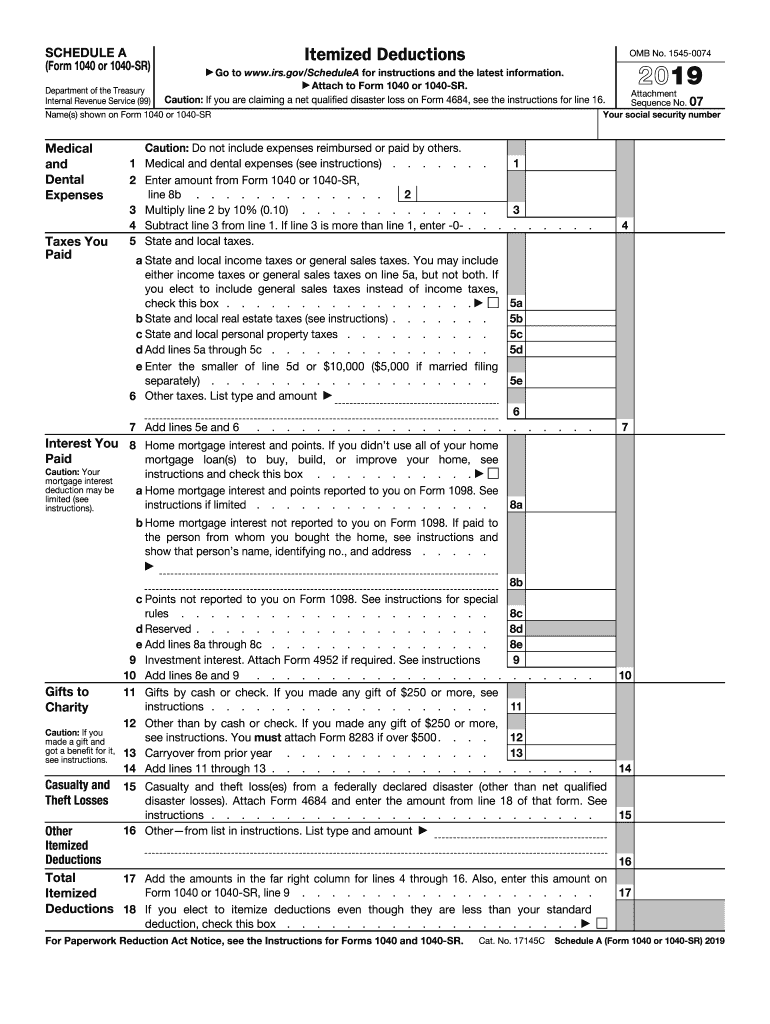

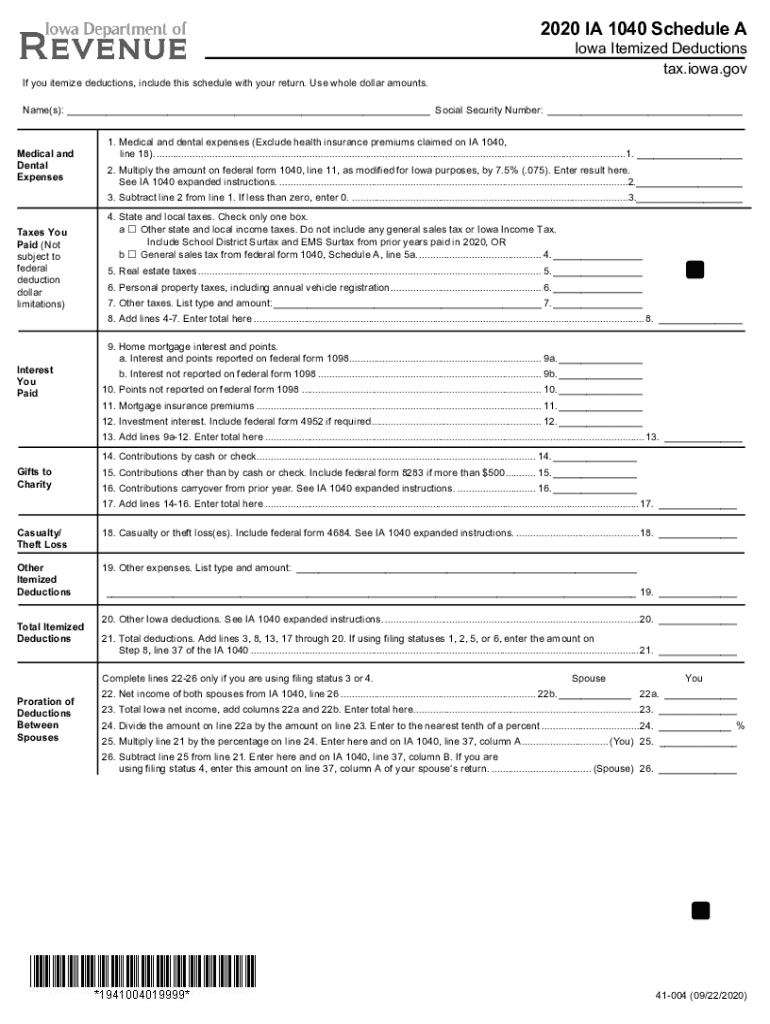

Some examples of itemized deductions include state and local taxes, mortgage interest, charitable contributions, and medical expenses.

High-income taxpayers should be aware of the increased threshold for itemized deductions. They should make sure that they have enough itemized deductions to exceed the threshold before they decide to itemize on their tax returns.

The increased threshold for itemized deductions is a tax increase for high-income taxpayers. High-income taxpayers should be aware of this change and make sure that they are considering all of their options before they decide to itemize on their tax returns.

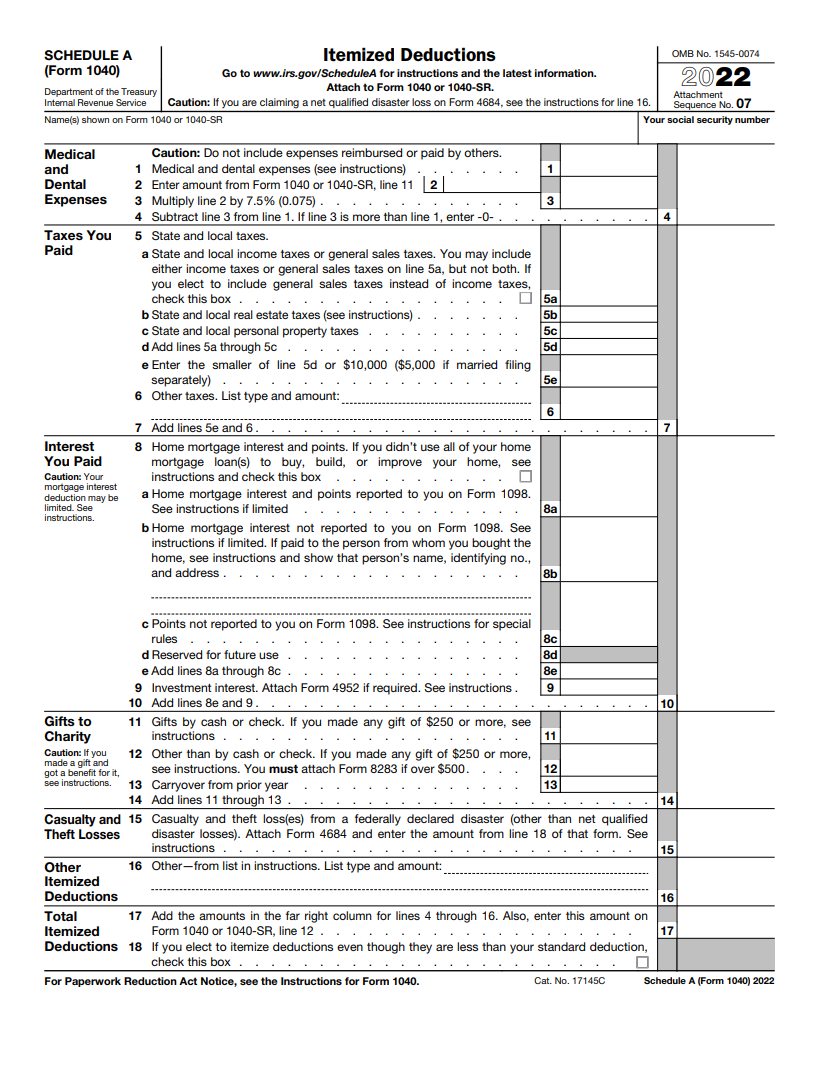

The medical expenses deduction allows taxpayers to deduct certain medical and dental expenses that exceed 7.5% of their AGI. However, the Tax Cuts & Jobs Act of 2017 reduced the threshold to 10% of AGI for expenses incurred after December 31, 2018.

The reduced threshold affects all taxpayers who itemize their deductions on their tax returns. This includes taxpayers who have high medical expenses and taxpayers who have low AGIs.

The reduced threshold means that taxpayers will have to have more medical expenses in order to itemize on their tax returns. This could make it more difficult for taxpayers to reduce their taxable income and save money on their taxes.

Some examples of medical expenses include doctor’s bills, hospital bills, prescription drugs, and health insurance premiums.

Taxpayers should be aware of the reduced threshold for medical expenses. They should make sure that they have enough medical expenses to exceed the threshold before they decide to itemize on their tax returns.

The reduced threshold for medical expenses is a tax increase for many taxpayers. Taxpayers should be aware of this change and make sure that they are considering all of their options before they decide to itemize on their tax returns.

The state and local taxes (SALT) deduction allows taxpayers to deduct certain state and local taxes from their federal income taxes. However, the Tax Cuts & Jobs Act of 2017 capped the SALT deduction at $10,000 for married couples filing jointly and $5,000 for other taxpayers.

The SALT deduction cap affects taxpayers who live in states and localities with high state and local taxes. These states include California, New York, and New Jersey.

The SALT deduction cap means that taxpayers can only deduct up to $10,000 of their state and local taxes from their federal income taxes. This could result in a higher tax bill for taxpayers who live in high-tax states.

Taxpayers who live in high-tax states should be aware of the SALT deduction cap. They should make sure that they are not claiming more than $10,000 of state and local taxes on their federal income tax returns.

The SALT deduction cap is a tax increase for taxpayers who live in high-tax states. Taxpayers should be aware of this change and make sure that they are considering all of their options before they file their tax returns.

The mortgage interest deduction allows homeowners to deduct the interest they pay on their mortgages from their federal income taxes. However, the Tax Cuts & Jobs Act of 2017 limited the mortgage interest deduction to interest on debt of up to $750,000 for new mortgages originated after December 15, 2017. For mortgages originated before December 16, 2017, the limit is $1 million.

This change affects homeowners who have mortgages that exceed the new limits. For example, if a homeowner has a mortgage of $800,000, they will only be able to deduct the interest on the first $750,000 of their mortgage. The remaining $50,000 of interest will not be deductible.

The mortgage interest deduction is a valuable tax break for homeowners. Homeowners who are considering buying a home or refinancing their existing mortgage should be aware of the new limits on the mortgage interest deduction.

In addition to the limit on the amount of mortgage debt that can be used to claim the mortgage interest deduction, the Tax Cuts & Jobs Act of 2017 also made changes to the rules for deducting points. Points are fees that are paid to the lender when a mortgage is originated or refinanced. Under the new law, points can only be deducted over the life of the loan if the loan is secured by the taxpayer’s main home.

The changes to the mortgage interest deduction and the deduction for points are significant. Homeowners should be aware of these changes and make sure that they are claiming the correct amount of deductions on their tax returns.

Question 1: What is the standard deduction for 2025?

Answer: The standard deduction for 2025 is $13,850 for single filers and $27,700 for married couples filing jointly.

Question 2: Who can claim the standard deduction?

Answer: Most taxpayers can claim the standard deduction. However, there are some exceptions. For example, taxpayers who itemize their deductions cannot claim the standard deduction.

Question 3: What are some examples of itemized deductions?

Answer: Some examples of itemized deductions include state and local taxes, mortgage interest, charitable contributions, and medical expenses.

Question 4: What is the threshold for itemized deductions for high-income taxpayers?

Answer: The threshold for itemized deductions for high-income taxpayers is 10% of AGI. This means that high-income taxpayers will have to have more itemized deductions in order to itemize on their tax returns.

Question 5: What is the reduced threshold for medical expenses?

Answer: The reduced threshold for medical expenses is 10% of AGI. This means that taxpayers will have to have more medical expenses in order to itemize on their tax returns.

Question 6: What is the cap on the SALT deduction?

Answer: The cap on the SALT deduction is $10,000 for married couples filing jointly and $5,000 for other taxpayers. This means that taxpayers can only deduct up to $10,000 of their state and local taxes from their federal income taxes.

Question 7: What is the limit on the mortgage interest deduction?

Answer: The limit on the mortgage interest deduction is $750,000 of debt for new mortgages originated after December 15, 2017. For mortgages originated before December 16, 2017, the limit is $1 million.

These are just a few of the frequently asked questions about the 2025 IRS 1040 Schedule A. Taxpayers should consult with a tax professional if they have any questions about their specific tax situation.

Tip 1: Gather your records. Before you begin filling out Schedule A, gather all of your records together. This includes your W-2s, 1099s, and other tax documents. You will also need to gather any receipts or other documentation that supports your deductions.

Tip 2: Read the instructions carefully. The instructions for Schedule A can be found on the IRS website. Be sure to read the instructions carefully before you begin filling out the form. This will help you avoid making mistakes.

Tip 3: Itemize only if it makes sense. The standard deduction is a dollar-for-dollar reduction of your taxable income. If your itemized deductions are less than the standard deduction, you should not itemize. You can use the IRS Interactive Tax Assistant to help you determine if you should itemize.

Tip 4: Be accurate. It is important to be accurate when completing Schedule A. Any mistakes could result in your tax return being rejected or audited.

By following these tips, you can help ensure that you complete your 2025 IRS 1040 Schedule A correctly and on time.

In addition to the tips above, here are a few other things to keep in mind when completing Schedule A:

The 2025 IRS 1040 Schedule A is a form that allows taxpayers to itemize their deductions on their federal income tax returns. Itemizing deductions can reduce your taxable income and result in a lower tax bill.

The 2025 Schedule A has several important changes from the 2025 Schedule A. These changes include the elimination of the deduction for unreimbursed employee expenses, the creation of a new deduction for qualified disaster losses, and the increase in the standard deduction. Taxpayers should be aware of these changes and make sure that they are claiming the correct deductions on their tax returns.

If you have any questions about the 2025 IRS 1040 Schedule A, please consult with a tax professional.